Independent since 1674

First came the cloth trade

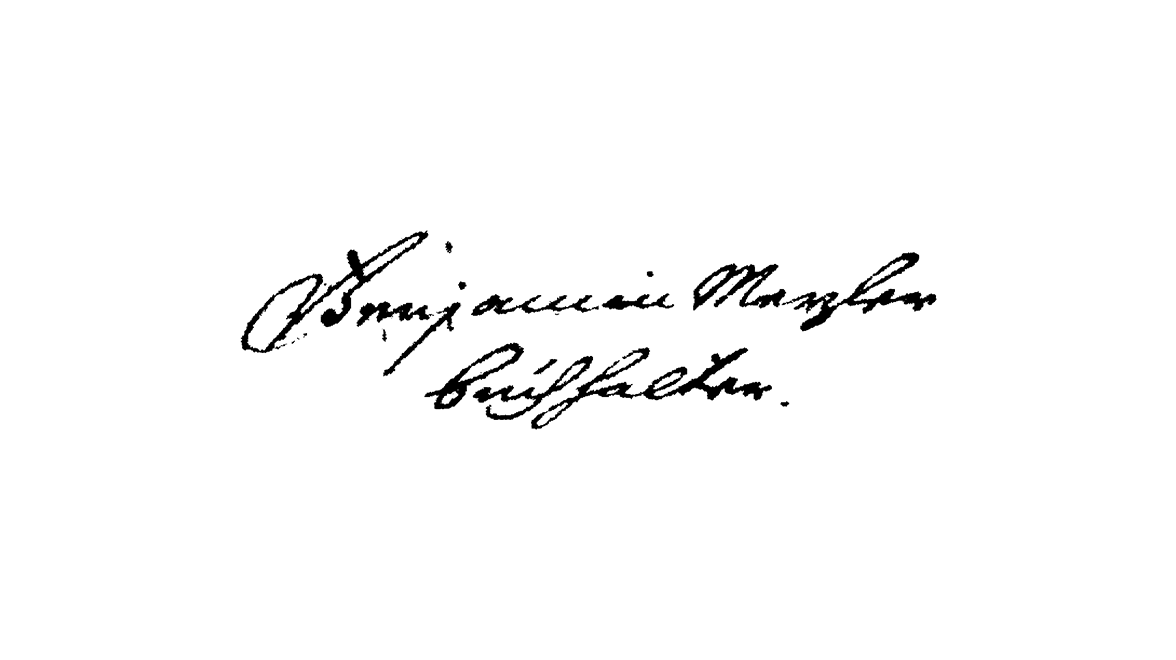

The origins of Bankhaus Metzler go back to a cloth trading business that Benjamin Metzler, a clergyman's son from the Vogtland in Saxony, founded in 1674. In 1663, Benjamin Metzler went to Nuremberg at the age of thirteen where he completed a training at a firm of merchants. In 1671, he moved to Frankfurt and worked there for three years at first as a bookkeeper in a well known firm of drapers.

From trading to banking

For hundreds of years, trade in Frankfurt, as in all other large European commercial centres, lived from the invigorating influence of merchant immigrants who streamed into the city from far and wide at regular intervals. In those days, Frankfurt profited from its location at the junction of important European trading routes. Increasingly, trade centred on commission and shipping business, and by the end of the 17th century this had led to a linkage of merchandise and financial transactions. Numerous Frankfurt private banks were spawned by this combination of shipping and commission business and short-term lending. The Metzler enterprise took the same path. The first dealings in money and bills of exchange were recorded in 1728. In 1738, Johann Jeremias Metzler titled himself a "marchand banquier", i.e. a businessman who dealt in both merchandise and bills of exchange.

18th Century: Government bonds

The development of the firm into a bank was largely completed around 1760 under the guidance of Christina Barbara Metzler.

In 1771, Friedrich Metzler, the first and one of the most outstanding bankers in the family, joined the management of the bank. As early as 1779, the year in which Gebrüder Bethmann floated the first million guilder bond for the German emperor in Vienna, the Metzlers became involved in the rapidly growing and profitable state lending business. Although the firm continued to have commercial dealings later, they were of only subordinate importance. While Gebrüder Bethmann financed the Habsburgs, Metzlers arranged funding for the Prussian royal house. In the Napoleonic era, Bankhaus Metzler withdraw from state lending and turned instead to stockbroking and securities safe custody business.

19th Century: Concentration on individual financial services

Towards the end of the 19th century, the management of Bankhaus Metzler realised that the direct competition it was facing from the newly formed joint stock banks would require the rapid growth of its balance sheet, which would sooner or later threaten the independence of the firm. It was likewise apparent that in this competition, which was fought out over volume, the real strengths of the private banker could not come to the fore. The reaction of the firm to this challenge was to establish a strategic alignment of its business that even today, over a hundred years later, shapes company policy decisively. Essentially, this consists in shunning on-balance-sheet business while concentrating on providing individual financial services – i.e. those fields in which the private banker has gained his real expertise over the centuries.

20th Century: Developing into an investment bank

Consequently, Metzler began early in the 20th century to limit its current account and lending business while at the same time expanding its securities dealings. In the dying days of the Imperial age and during the period of the Weimar Republic, Frankfurt steadily lost out to Berlin in importance as a financial centre. This and an increasingly more intractable general economic environment adversely affected private banks in Frankfurt. The world economic crisis that broke in October 1929 and the major banking crisis of July 1931 took an additional heavy toll. However, Bankhaus Metzler was able to survive these difficult years under its own steam. In the period of the "Third Reich" and the Second World War, banking business was subdued due to the wide-ranging legal restrictions placed on the industry and the isolation of the country from the outside world.

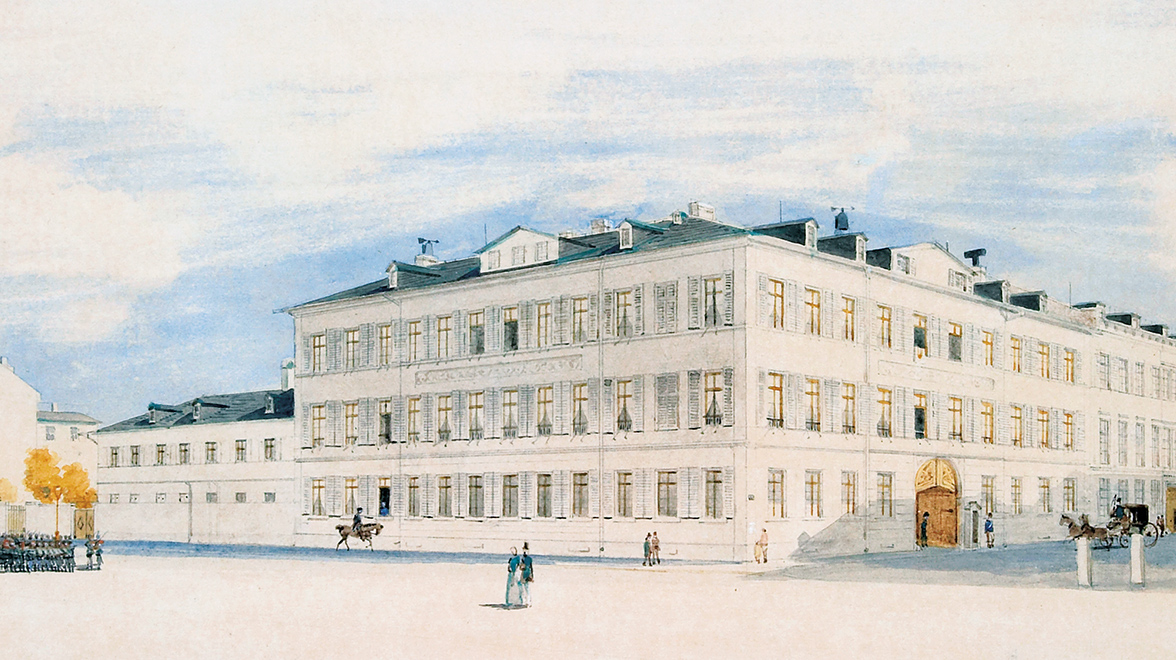

In March 1944, the bank's office building in Frankfurt in Grosse Gallusstrasse, which had been acquired early in the 19th century, as well as most bank records were destroyed by fire following an air raid. After the war, banking business began to return to normal only slowly. The owners of the bank resolutely adopted the strategic line followed in the pre-war years, concentrating their efforts on banking services.

The Metzlers were thus extremely well prepared for the expansion of global securities markets that took hold at the end of the 1970s. Of particular benefit was the fact that the bank's securities business was centred in Frankfurt. At the same time, Metzler continued to pursue its goal of transforming the bank into an investment firm along Anglo-Saxon lines. Commercial business faded more and more into the background while securities advisory services and trading, wealth management, foreign-exchange counselling and dealing, foreign-trade business and corporate finance grew in importance.

In order to secure the independence and continuity of the company in the long term and strengthen its capital base, it was converted in 1986 from a partnership into a limited company in the form of a partnership partly limited by shares. Without any input from outside sources, this enabled the bank's equity capital to be stocked up substantially while it continued to follow the principle of building up hidden reserves. Shareholders of the company remained restricted to members of the von Metzler families. This legal form preserves the character of a private bank because the partners are still personally liable. At the same time, a holding structure was devised patterned on constructions in the Anglo-Saxon banking world, with the parent company bearing the name B. Metzler seel. Sohn & Co. Holding AG. Since then, the various business fields, of which the notion of individual customer service has always formed the core, have been the responsibility of independent sister companies of the bank.

English

English ジャパニーズ

ジャパニーズ